These loans are best for those who know they can offer or re-finance, or for those who can reasonably expect to manage the higher month-to-month payment later on. Another kind of home mortgage you might discover is a balloon mortgage, which requires a big payment at the end of the loan term.

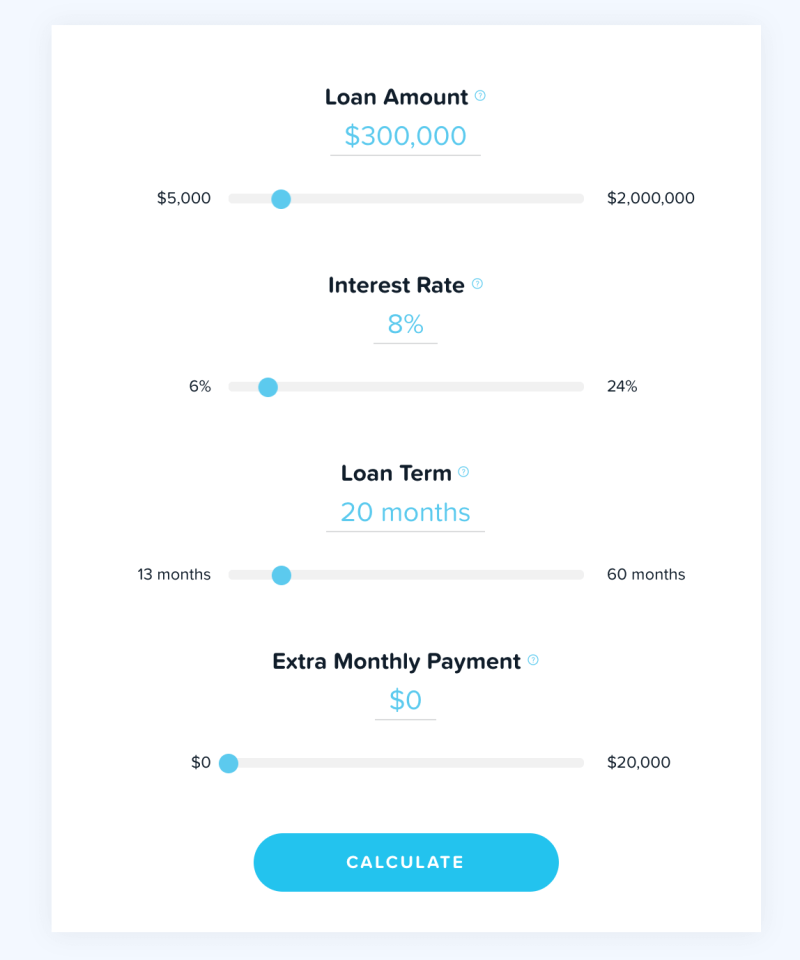

At the end of that time, you'll make a large payment on the exceptional balance, which can be uncontrollable if you're not prepared. You can utilize the balloon mortgage calculator to see if this sort of loan makes good sense for you. Before moving on with any home loan, carefully consider your financial situation.

When I was a little woman, there were three home loan types offered to a home buyer. Purchasers might get a fixed-rate traditional mortgage, an FHA loan, or a VA loan. Times have actually absolutely altered. Now there are a dizzying selection of mortgage types available-- as the saying goes: more home loan types than you can shake a stick at! This is the granddaddy of them all - who does stated income mortgages in nc.

FHA mortgage types are guaranteed by the government through mortgage insurance that is funded into the loan. Newbie property buyers are perfect candidates for an FHA loan since the down payment requirements are minimal and FICO scores do not matter. The VA loan is a federal government loan is readily available to veterans who have served in the U.S.

Getting My Which Congress Was Responsible For Deregulating Bank Mortgages To Work

The requirements vary depending upon the year of service and whether the discharge was honorable or dishonorable. The primary advantage of a VA loan is the debtor does not need a down payment. The loan is ensured by the Department of Veterans Affairs but funded by a traditional lending institution. USDA loans are provided through the U.S.

Oftentimes, there is no deposit, and a USDA loan may even be more inexpensive than an FHA loan. Calling a home loan type an "interest-only home mortgage" is a bit misleading because these loans are not actually interest-only, implying the customer pays just interest on the loan. Interest-only loans contain an option to make an interest-only payment.

However, some junior home loans are indeed interest-only and require a balloon payment, consisting of the initial loan balance at maturity. Choice ARM loans are made complex. They are variable-rate mortgages, implying the rates of interest changes occasionally. As the name implies, borrowers can select from a variety of payment alternatives and index rates.

This type of mortgage funding includes 2 loans: a very first home mortgage and a second home loan. The home mortgages can be adjustable-rate mortgages or fixed-rate or a mix of the 2. Borrowers take out 2 loans when the down payment is less than 20% to avoid paying private mortgage insurance coverage. Adjustable-rate home loans (ARMs) can be found in lots of tastes, colors, and sizes.

What Type Of Insurance Covers Mortgages for Beginners

It can move up or down monthly, semi-annually, every year, or remain repaired for a time period before it adjusts. Customers who want to pay a lower rates of interest at first typically select mortgage buydowns. The rate of interest is lowered due to the fact that costs are paid to decrease the rate, which is why it's called a buydown.

Like the 203K loan program, FHA has another program that provides funds to a borrower to repair up a house by rolling the funds into one loan. The dollar limitations for repair are lower on a Streamlined-K loan, however it requires less paperwork and is simpler to acquire than a 203K.

The seller's existing home is used as security for a bridge (likewise called swing) loan. Equity loans are 2nd in position and junior to the existing first home loan. Customers secure equity loans to receive https://diigo.com/0inho3 cash. The loans can be adjustable, repaired, or a line of credit from which the debtor can draw funds as needed.

Because this provides the lending institution a guaranteed return, it generally suggests a lower rate of interest and a lower monthly payment on the loan. Reverse home loans are readily available to any person over the age of 62 who has enough equity. Rather of making monthly payments to the lending institution, the loan provider makes monthly payments to the borrower for as long as the borrower resides in the home.

The Buzz on What Are The Requirements For A Small Federally Chartered Bank To Do Residential Mortgages

If you're going to be accountable for paying a home mortgage for the next 30 years, you need to know exactly what a home mortgage is. A mortgage has 3 standard parts: a deposit, month-to-month payments and fees. Because mortgages typically include a long-lasting payment strategy, it is necessary to comprehend how they work.

is the amount needed to pay off the mortgage over the length of the loan and includes a payment on the principal of the loan as well as get out of a timeshare interest. There are often residential or commercial property taxes and other fees consisted of in the monthly costs. are different expenses you have to pay up front to get the loan.

The larger your Homepage deposit, the much better your funding deal will be. You'll get a lower home mortgage rate of interest, pay fewer charges and get equity in your home more quickly. Have a great deal of concerns about mortgages? Take a look at the Consumer Financial Security Bureau's responses to frequently asked questions. There are 2 primary types of home loans: a conventional loan, guaranteed by a personal lending institution or banking institution and a government-backed loan.

This removes the requirement for a deposit and likewise prevents the need for PMI (personal home loan insurance coverage) requirements. There are programs that will help you in acquiring and financing a mortgage. Talk to your bank, city advancement workplace or an experienced property agent to discover out more. The majority of government-backed mortgages can be found in among 3 forms: The U.S.

The Ultimate Guide To How To Reverse Mortgages Work If Your House Burns

The first step to get a VA loan is to acquire a certificate of eligibility, then send it with your latest discharge or separation release documents to a VA eligibility center. The FHA was produced to assist individuals obtain budget friendly housing. FHA loans are in fact made by a loan provider, such as a bank, however the federal government insures the loan.

Backed by the U.S. Department of Farming, USDA loans are for rural property purchasers who are without "good, safe and hygienic housing," are unable to protect a home mortgage from standard sources and have an adjusted earnings at or below the low-income limit for the location where they live. After you pick your loan, you'll choose whether you desire a fixed or an adjustable rate.

A fixed rate mortgage requires a regular monthly payment that is the very same amount throughout the term of the loan. When you sign the loan papers, you concur on a rate of interest and that rate never changes. This is the very best type of loan if interest rates are low when you get a home loan.

If rates go up, so will your home loan rate and month-to-month payment. If rates increase a lot, you might be in huge problem. If rates go down, your mortgage rate will drop therefore will your month-to-month payment. It is normally most safe to stick with a fixed rate loan to secure versus rising rates of interest.