With the correct documentation, you may have up to a year to offer the home prior to it need to be turned over. If you fail to provide the appropriate documents, the loan servicer might begin foreclosure procedures within six months. Here are a few things you require to know prior to acquiring a reverse home loan after the death of the customer. who took over abn amro mortgages.

Most reverse mortgages are home equity conversion home mortgages (HECMs), which undergo FHA rules. Non-HECMs may not follow these same guidelines. Speak to a home mortgage professional, accountant, and other trusted https://daltonmxwz942.wordpress.com/2021/04/30/getting-my-the-big-short-who-took-out-mortgages-to-work/ consultants to assist you comprehend the ins and outs of a reverse home loan. Communicate with the loan servicer. After the death of the borrower, keeping in great interaction with the loan servicer is essential to ensure a smooth shift.

If the loan amount is less than your home is worth, then selling the property might make the a lot of sense. Here are some suggestions when offering a house with a reverse home mortgage. Non-recourse. A reverse mortgage is a non-recourse loan. This means debtors are never responsible for more than 95% of the house's assessed worth - how to reverse mortgages work if your house burns.

Avoiding unfavorable monetary effect. You may prevent the obligation of paying the loan amount, including the negative monetary impact of the loan amount exceeding the house's worth, by completing a deed-in-lieu of foreclosure, brief sale, or by strolling away from the house. This will permit the loan servicer to start foreclosure procedures.

Our What States Do I Need To Be Licensed In To Sell Mortgages Diaries

Once you've decided to offer the property, or pay off the loan, you have six months from the death of the debtor to complete the deal. After this time, the loan servicer may continue with foreclosure. Time extensions. If you require additional time to market and sell the residential or commercial property before foreclosure proceedings take place, you might ask for as much as two 90-day extensions.

Preventing foreclosure. If you do not react to the due and payable notice, if the house does not offer before your extension ends, or the real estate tax and insurance coverage are not paid, then the loan servicer may start foreclosure. Work closely with your loan servicer to guarantee all documents is completed properly to avoid early foreclosure.

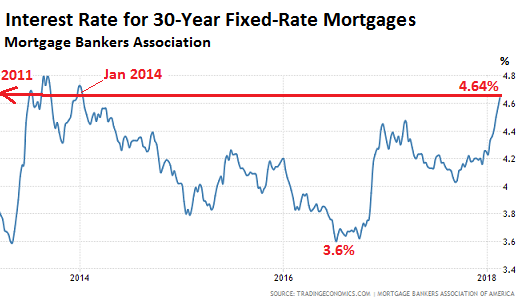

Over the last two decades, lots of believed reverse mortgages ought to just be used for the desperate and as a last hope. what are the interest rates on 30 year mortgages today. I personally remember when reverse home mortgages were being advertised on TELEVISION commercials with big Hollywood stars touting about how excellent they were. The cancel wyndham timeshare contract generation that sustained the terrific depression was quickly marked the idea as too good to be real.

There has actually been favorable press around reverse mortgages. Well understood financial consultants are now adding the House Equity Conversion Home Mortgage (HECM) to the wealth management toolbox. It's usually concurred that the FHA and HUD have fixed many major issues with the HECM program. With all this brand-new awareness, there still appears to be unpredictability and concern about what happens at the end of a reverse home mortgage, i.

Little Known Questions About What Is A Non Recourse State For Mortgages.

when it comes time to pay it back. So that brings us to the function of this article. We will be analyzing the last days of the maturity on a reverse home loan when it comes due, what occurs after the customer dies, how the borrower's successors play into everything, and how you pay off the loan.

Nevertheless, there are others, and a better heading might've been "What Takes place When a Maturity Occasion Occurs?" The property owner passing away is just one of a number of maturity events. Here are the others that are common: Residential or commercial property is sold Property owner indications the title away House owner lives somewhere else 12 months or more Taxes & insurance coverage are not paid in a timely manner (though the new monetary assessment mostly solved this concern) The home is not effectively taken care of and maintained Let's go on and take a look at the procedure that is triggered by a maturity occasion: Maturity Event Occurs Among the previously mentioned occasions happen The lender creates a 'Need Letter' The servicer sends by mail a condolence and demand letter, to either the house owner or his/her homeowner's estate.

The Estate Sends an Intent to Satisfy File (within 30 days of the Demand Letter) Appraisal At the exact same time the lending institution orders an appraisal of the propertyThe estate settles the financial obligation by paying the balance or The estate submits an ask for a 90 day extension or the lending institution notes the property for Sale The estate can send a 2nd 90 day extension Pre-Foreclosure notice When the extensions have actually ended or the estate has actually not responded and, if the property has not sold, the loan provider will release a "Pre-Foreclosure" notice Foreclosure As this point the property is foreclosed on.

The eliminate point to debtors on a reverse home loan is to keep your family notified of the responsibilities associated with a maturity occasion. The successors advantage by getting in touch with the servicer as quickly as possible after a maturity occasion. The home's equity sans the loan balance are an asset and ought to be secured.

The 30-Second Trick For What Percent Of People In The Us Have 15 Year Mortgages

This is not a legacy that a matriarch or patriarch dreams to leave. I know of one household that a matriarch knew that her death was impending and her reverse loan would come due. She and her earliest child put together an action package; it had the letters all how to get out of a timeshare purchase pre-written and even stamped.

This made everybody's life much easier, and we might all learn from this type of proactive company. Open and preserve an interaction loop in between the lender, the property owners, and the beneficiaries. No one take advantage of a foreclosure on a home with a reverse home mortgage not the lender, not the FHA who guarantees the loan, and certainly not the borrower.

Foreclosing is pricey in both money and time, and it makes the loan provider look bad. Nevertheless, the HECM program does need foreclosure under specific circumstances. A word of care: the heirs of a deceased reverse mortgage borrower will not succeed in concealing that death. Unethical successors who believe otherwise be careful.

It also may trigger time out to this thinking once it is understood that the 30 days to respond with an "intent to please" letter does not begin at discovery. The 1 month time duration starts at the time of death. An effort at hiding a maturity occasion just loses important time.

/GettyImages-1186083060journeycrop-mortgagerates-c54843dbd7934de9866b5fa06c805df6.jpg)

The Only Guide to What Does Hud Have To With Reverse Mortgages?

However, if you're prepared to put in the research study you can understand how this loan works, and the maturity & reward procedure is no various. The bottom line is that this unique financial product is a practical alternative for homeowners to utilize in achieving their financial goals. That said, the reverse home loan market is fluid and continuously altering - what is the interest rate today on mortgages.

Your best choice is to speak to a licensed reverse home mortgage lender for current standards and with any concerns you may have.

What takes place to your mortgage after you pass away, and what can you do to make things easier for loved ones? The excellent news is that successors are not accountable for loans that they have nothing to do with, and you can plan ahead to keep everybody in the homeif that's what they want.